Are you ready to let the potatoes grow?

A potential new client sent me a long email last week. It was full of questions. What are your fees? How do I get out of the agreement? What if you're sick? Are you independent? And then, back to fees again.

All reasonable questions. All answered before - in the documentation I'd already sent.

But what was interesting was that this person had been referred by a client I've worked with for 20 years. They'd already sent me spreadsheets, policy documents, personal financial details. They'd shown me their money. They trusted me with the information. They just couldn't take the leap.

Or rather, they didn't realise they already had

I was at a conference last month where someone talked about trust and leaps of faith. The timing was perfect because I'd spent the previous few days thinking about that email.

Why was this potential client focusing on exit clauses and contingency plans when their friend - someone they presumably trust - had worked with me for two decades? Then it clicked. They had taken a leap of faith. They'd shared their financial life with a stranger. They'd done the hard part. But because they couldn't see the outcome yet - because the potatoes were still underground (I’ll come back to potatoes later) - they were focusing on the only things that felt tangible. Fees. Contracts. Escape routes.

The thing is, with my existing clients, we're miles beyond that conversation. We've been through weddings, house moves, redundancies, illness, inheritances. We've had tears and laughs. We've navigated markets that felt terrifying and come out the other side. The trust isn't about the fee structure anymore. It's about everything that came after they took that first leap.

Do the work (or don't pretend you will)

Around the same time, I had my first proper interaction with generative Artificial Intelligence (AI). I've been trying to train for a run, yes another one, and had a nagging Achilles injury that was bothering me. I asked for advice, and the AI was remarkably direct. After I kept circling back to the same questions, it basically said: "You've already asked me this. What you really need to do is what we’ve just covered."

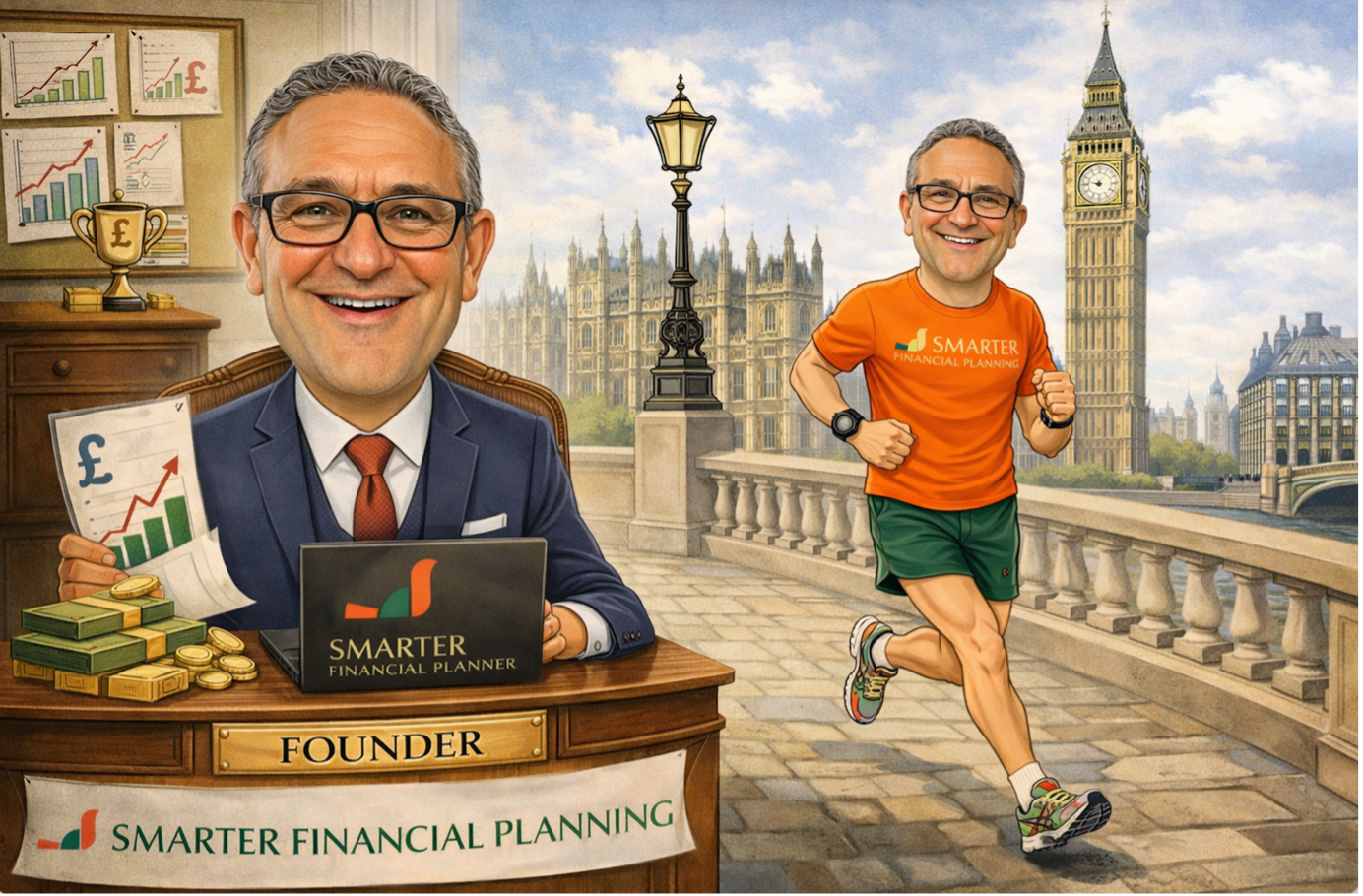

What AI thinks I look like – disturbingly accurate!

It was oddly refreshing. I realised I was avoiding the doing - the actual work of rest and recovery. I was playing for time, looking for a different answer, something easier – a hack may be?

I was doing the same thing as the prospective client who was asking me the questions I’d already answered.

The difficulty is that financial planning requires you to engage with uncertainty. You have to make decisions about a future you can't see. You have to trust a process that doesn't give you daily reassurance. You have to plant potatoes and then leave them alone (I promise I will come back to potatoes).

If you're not ready for that, no amount of detail about fees and exit clauses will make you comfortable.

Death, certainty, and the comfort of control

I spoke to a client recently who's a counsellor for the terminally ill. A remarkable person. I asked her how she stays so positive when her work is so heavy. She said something brilliant, to paraphrase: "Dying is certain. We know it's going to happen. What I struggle with is the uncertainty, about money."

Think about that. Death - the ultimate unknown - feels manageable because it's inevitable. But money, investing and retirement planning feels terrifying because we don't know exactly how it will turn out.

Maybe that's the key insight: we're not actually looking for certainty. We're looking for comfort with uncertainty. A way to make decisions and then live with them, even when we can't see the potatoes growing underground.

Finding the middle ground

Here's a useful example that landed in my inbox this week. Someone had worked out that if you'd bought an iPhone every two years since 2013, you'd have spent about £6,000 with Apple. You'd have a shiny iPhone 17 today.

If instead you'd invested that £6,000 in Apple shares (buying on the day each phone was released), you'd have £32,000 today. But you'd have had no phone for over a decade. Not exactly practical.

But what about the middle ground? What if you'd upgraded every four years - every Winter Olympics, let's say - and invested the money from the "missed" upgrades in Apple shares?

You'd have spent £3,300 on phones. You'd still have that new iPhone 17. But you'd have invested £2,700 and turned it into £12,700.

Not as dramatic as going without a phone entirely. But meaningful. Sustainable. Sensible.

This is what I'm trying to help clients do with their entire financial lives. Not save every penny and never enjoy anything. Not spend everything and hope for the best. Find your sustainable middle ground.

Guarding the potatoes

Ok potatoes: My dad has six allotments. Grows potatoes, among other things. The thing about potatoes is they grow underground. You can't see them. You don't get daily feedback. The temptation, for the novice, or impatient, is to dig them up to check on progress.

Every time you do that, you damage roots. You stress the plant. You reduce the harvest.

Markets work the same way. The real compounding happens quietly, invisibly, over time. The temptation is to constantly check, tinker, react to headlines, make changes based on how things feel right now rather than what makes sense long-term.

A client came in for a review meeting recently, visibly anxious. They thought something must be wrong because I'd called the meeting. The portal login wasn't working, they couldn't see their investments, and that worried them further.

But the review was routine. It happens anyway. Doesn't mean something's gone wrong. Sometimes we just need to check the plan is still right for where you are now, then leave the potatoes alone.

Trust is built in the doing

That potential new client will make their decision. Maybe they'll come on board, maybe they won't. Either way is fine. But I realised something through the whole experience: I can't make someone trust me. I can only be trustworthy.

The clients I've worked with for years didn't start out certain about everything. They took a leap. They did the work - the awkward work of being honest about money, looking at worst-case scenarios, making decisions about uncertain futures. They let the potatoes grow.

And somewhere along the way, the questions changed. They stopped being about fees and exit clauses. They became about weddings and funerals and job changes and inheritances.

About life.

If you're reading this as one of those clients - thank you. Thank you for taking that leap, however long ago it was. Thank you for doing the work, even when it was uncomfortable. Thank you for letting the potatoes grow.

And if you know someone who might be ready - or nearly ready - to take their own leap, I'm always grateful for introductions. Not because I'm actively looking for new clients (I'm really not), but because the best working relationships I have started exactly this way. With someone who trusted you, taking a chance on trusting me.