How to invest without regret

When we first started working together, Kenny and Valia were approaching retirement. Diligent and risk-averse savers, they’d managed to build a substantial nest egg without being too adventurous with their investments, never venturing beyond banks and building societies. We worked together to create a more diverse portfolio recognising the level of risk they were prepared to take.

Imagine my surprise a couple of years on when we reviewed their progress and found that they’d become even more cautious than before. They’d become used to investing and hadn’t made any losses, so I couldn’t understand it — especially since the textbooks suggest your attitude to risk usually remains constant.

As it turns out, their risk appetite had fallen because their goals had got closer. They had a grown-up daughter they were keen to take care of. The last thing they wanted was to lose money they’d secretly set aside for her house deposit and wedding. Most of all, they were worried about making decisions they’d regret later on.

The Wall of Worry

Like many advisers, I have a high tolerance for risk. In fact, my own portfolio is 100% made up of equities, company shares. It’s what many might call a ‘no sleep at night’ portfolio, but it’s low-cost and fully diversified to reflect the global economy.

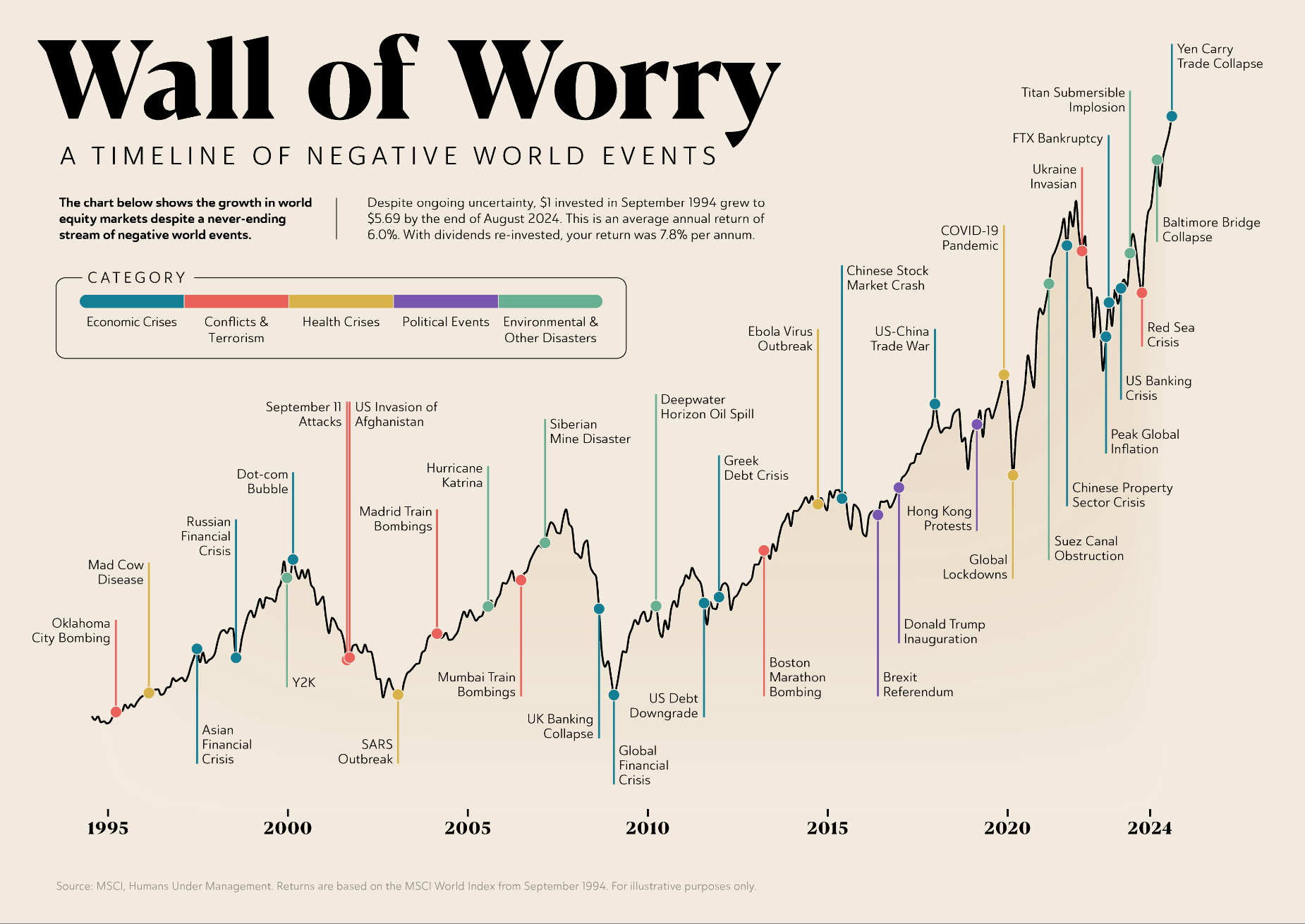

Having worked in financial services for 30 years now, risk feels like a no brainer, in fact it’s an opportunity. I’ve already seen it all. Inflation, recessions, financial crises, wars, mining disasters and oil spills. Not one of these events has toppled the stock market, made up of the great companies of the world, not even the pandemic!

As the graph below shows, when markets drop in response to economic, political or societal uncertainty, these declines are only temporary.

So even if my portfolio fell from £1m to £750,000, it’s not something to lose sleep over. All I need to do is look at the Wall of Worry and remember how resilient the stock markets are.

My investments could bounce back within a matter of days, as many investors experienced in March 2020. But even if it takes years for my investments to reach previous highs, the average is 26 months to recovery, I’d still be ok because I have a plan – a plan aligned to when I’d like to stop working, when I need the money, and what I want to do with it.

Approaching retirement

No one wants to have to sell their investments in the middle of a crash - sorry I mean temporary decline - even if it’s survivable. This is why I ask all my clients to consider when they need the money and what they’d like the money for.

Another question (one that takes many clients by surprise) is how long they expect to live. We might not have a crystal ball, but it’s a helpful exercise. Forever the optimist, I’m hoping I’ve got another 30 years in me! Despite the creaks, the statistics are with me, and in couples, the majority will have one long-term survivor.

I know that whether I retire with a million or half as much, I won’t need access to it all in one go. This is why it doesn’t matter if my portfolio’s underperforming the year after I retire, or it loses 30% of its value in a crash. As long as I’ve always got cash set aside for the next 3-5 years’ worth of income, the rest can stay invested.

The thought of a three-decade retirement might terrify those who worry about running out of money, but the way I see it, a long retirement can give you a career’s worth of time to continue building your pension pot. You just need the right foundations.

Of course, the older I get, the more significant a temporary decline is. Not everyone has a 30-year timescale, but it’s my job to adjust for that and consider what the beneficiaries will want to use the money for.

A greater return on your investment

While my attitude to risk couldn’t be further from Kenny and Valia’s, something we do have in common is a desire to put our daughters’ needs first.

I started investing for my daughter’s future when she was really young, opening an investment account and contributing to it regularly, saving Child Benefit. I watched it compound, year after year, before finally selling down her investments and gifting her a pot of money when she graduated from university.

The money wasn’t earmarked for anything in particular. I was happy for her to spend it on whatever mattered most to her - be it a car, wedding, house or PhD.

We were able to help our daughter in a way that many parents can’t, and yet I still have regrets. Inflation has eaten away at Sophie’s savings over the years that followed. If we’d just left the money where it was, it would’ve grown by 9.2% each year instead of stalling while it sits unspent.

I silence these regrets by reminding myself why we opened the investment account in the first place: to give Sophie financial freedom and autonomy in adulthood.

We didn’t want to dictate how she spent the money, and we certainly didn’t want her to ask us for permission to access it. What would I have said if she wanted to use the money and the markets were down? “Sorry, you can’t buy your dream home because we were worried about inflation! Don’t worry, in 2-3 years’ time it’ll be fine.”

Sophie might not be as wealthy as she could’ve been, but we’ve made a much greater return on our investment than we would’ve done had we kept her money in a stocks and shares ISA until today – at least on a personal and emotional level, anyway.

Staying in your own lane

It’s hard to get through the festive season without at least one unsolicited conversation about crypto, NFTs or some multi-level marketing opportunity. Most people lose money on these types of ‘investment’, but few are willing to admit this at the dinner table.

It’s easy to get swept up, especially if your own investments are moving at a steadier inflation plus 3%, but over time you will win.

According to data from the Financial Regulator, 12% of UK adults now own crypto, with the average investment £1,842. You’re not missing out, have no fear. If you want to speculate or gamble with a similar bit of fun money, then fine*, but keep your family fortress of investments strong.

What those people know (and you might forget in the moment) is that you’re on your own inevitable path to wealth. You already have a plan – you know when you’d like to stop working, when you need the money and what you want it for. The last thing you need is to get sidetracked by some ‘unmissable’ opportunity, which might derail all those plans.

Sometimes you have to trust yourself that you’re making right choices, using the best information you have at the time. Trust me, too. With my help, you’ll have the money you need, for the life you want, at the right time. There’s no use torturing yourself at night wishing you’d done things differently.

*Remember, crypto isn't actually regulated, which means you can lose all your money. Unlike regular investments, there’s no protection from the Financial Ombudsman or the Financial Conduct Authority.