Is now really a good time to move to cash?

With interest rates on the rise, you might be tempted to sell your shares and pour money into cash instead.

Selling your investments during times of uncertainty can seem like a sensible move, especially with an increasing number of banks offering 4% or more on savings. But history shows that markets do eventually rebound after downturns. Stock market slumps are part and parcel of investing. Thankfully, the same can be said for the recoveries.

Liquidating your assets before you’ve reached your goals is unlikely to have a positive impact on your long-term finances. Here are some things to think about before you make any changes.

“The key to making money in stocks is to not get scared out of them.” –Peter Lynch

Cash: The uncomfortable truth

If you put £10,000 into a savings account, you can be confident that your money will be there when you need it. If the bank offers you 4% interest, you’ll have £10,400 at the end of year one.

Should something happen to the bank or building society in question, the Financial Services Compensation Scheme would offer you protection of up to £85,000 per bank/banking group.

And yet, while cash is widely considered ‘low risk’, it’s almost guaranteed to provide you with a negative return in real terms. Inflation is always higher than the interest rates offered on savings.

With inflation at 8.7%, products and services that would’ve cost you £10,000 on day one will now cost you £10,870.

Cash is king for short-term goals, so this isn’t the end of the world — especially if you’ve set the money aside for a holiday, house deposit or emergency. In the long term, however, inflation can quickly eat into the value of your savings and leave you with far less purchasing power than you imagined.

Goods worth £10,000 in 2013 would cost us £14,040 today, considering the rate of inflation over the last 10 years. Meanwhile, had you placed £10,000 in the average building society a decade ago, you’d be rewarded with just £470 in interest today.

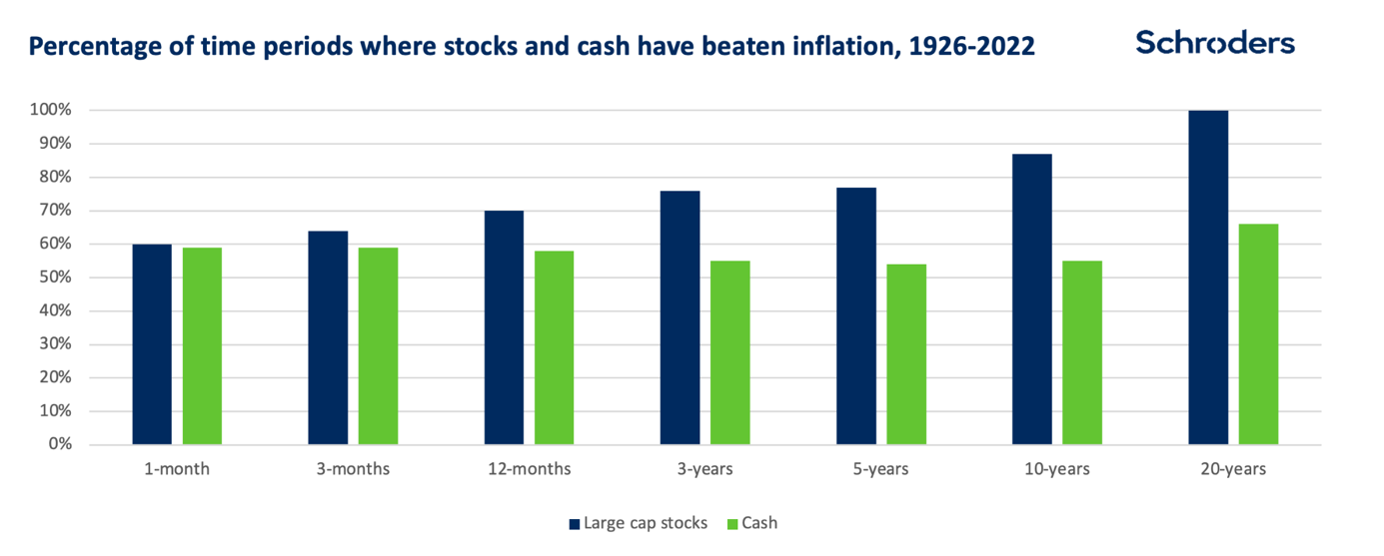

The chart below crunches historic returns on cash and stock market investments over a range of timeframes extracted from 96 years’ data. It then sets these against inflation over the same timeframes.

The results are stark. The chart shows that over very short periods – three months or less – there has not been much difference in the likelihood of cash or shares beating inflation. But for longer periods the gap widens conclusively.

Different strokes for different folks

This month the Bank of England announced its 13th consecutive interest rate rise, bringing the Bank Rate to 5%. With more than 2.4m fixed rate mortgage deals set to expire before the end of 2024, you might be concerned about your children’s finances as well as your own.

If you’re thinking of selling your own shares to help your children pay their mortgage off early, don’t do anything hasty. For some, selling a percentage of their investments could be a sensible move, particularly if such an action will reduce their inheritance tax obligations.

For others, selling stocks, properties, cryptocurrency, you name it, to pay off their offspring’s debt could impact their own financial stability in the future — and even lead to inheritance tax issues should they pass away within seven years of gifting the money.

This is why I consider every aspect of a client’s financial situation before making a recommendation. A life-changing move for one person could be the worst financial decision of another person’s life.

Weighing up the maths vs psychology

When interest rates were low, money was cheap, it made little sense mathematically to pay a mortgage off early. You could generate a much larger return from the stock market.

But the psychological side of money is just as important as the financial. If your mortgage is a source of anxiety, achieving that mortgage-free milestone can have a greater impact on your life than pouring your cash into investments. I’ve actually been to two ‘mortgage paid off parties’ of friends – they do exist! Not necessarily the wildest bashes, but great fun. Seriously though, whenever we make a big financial decision, we pay the price for it one way or another.

I have a client who’s a member of a pension scheme with options, and they’re wondering whether to take an enhanced lump sum which involves trading off a lifetime of guaranteed pension. They want me to tell them what’s best. I can set up a spreadsheet and work out the best options financially, but the best computer calculated financial option isn’t necessarily the best option for the human that’s involved

This particular client is almost 60 and based on their health and life expectancy data, we think they’ll live to 92. If they do live that long, they might be best keeping their pension rather than taking a lump sum. By keeping the pension, it’ll continue to compound. However, if they take the lump sum now, they could give money to their children and help them buy houses and have some fun with it. We can take the maths into account, sure, but it’s not the be-all-and-end-all.

I’ll often make recommendations based on a client’s risk tolerance. There’s no point forcing volatility onto someone who’s spent most of their life likening the stock market to a casino. But once we’ve got a financial plan in place and we’ve made progress towards our goals, we need to avoid making decisions based on fear. When we make changes to our portfolios in response to bad news, that’s panic selling. And it’ll only take you further away from your goal.

You can find yourself trapped in a cycle: selling your stocks at a loss and buying them back again at a higher price when your confidence has returned. You sell your stocks because you crave stability, but 5, 10 and even 20 years later, you might still be searching for it.

Panic selling is human nature. We’re hardwired to protect ourselves in times of uncertainty. But to reach our long-term financial goals, we need to take a deep breath, avoid the neverending news cycle, and focus.