What did you spend your first wage packet on?

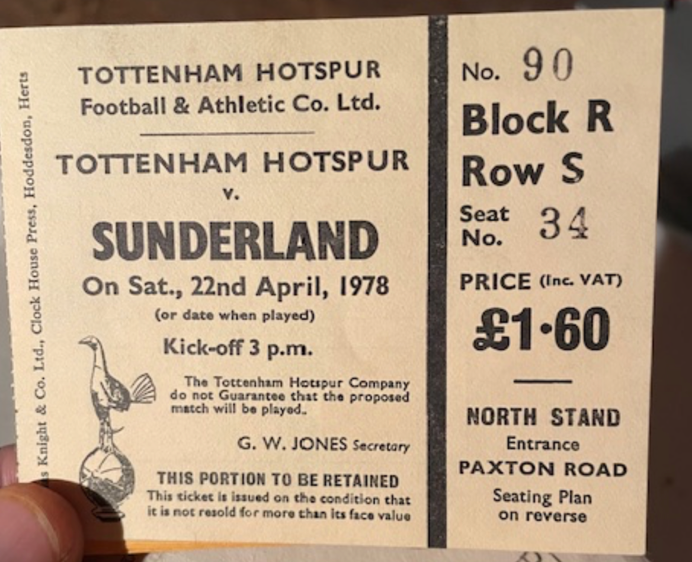

Just before Christmas, I found myself climbing into the loft to make space for the electrician who was coming in to do some rewiring, and I stumbled across a treasure I hadn’t seen in decades: a ticket to the first-ever football match I attended. It was the Mighty Spurs versus Sunderland on April 22, 1978, I was 11 years old.

As you can see, the ticket cost £1.60 back then** - hardly the £100++ you’d pay for such entertainment today! It was the beginning of my lifelong rollercoaster journey with Spurs, and finding that ticket transported me back instantly to those more innocent days, and then got me thinking about memories, inflation, and – of course – how we spend our money.

(** £1.60 invested in MSCI World Equity Index on 22/4/1978 would be worth £28,380 today.)

Money always tells a story

Take your first pay packet, for example. I recently read about a footballer who spent his first professional wage on a sports car. Flashy? Yes. A good investment? Not so much. If he’d put that money into stocks and shares, it would be worth millions today, while the car has likely depreciated to nearly nothing. Who is to say it’s a bad choice though?

What about you? What did you spend your first wage packet on? My assistant Sarah remembers hers clearly. She bought a ghetto blaster that had a new-fangled LED screen which meant it said "hello" when she turned it on and "goodbye" when she switched it off. She described it as “magical”.

Looking back, these purchases aren’t just about the money; they’re about the joy they brought us. For most people, their first pay packet or grant cheque wasn’t just another deposit in the bank - it was an opportunity to indulge, or in the case of the pay packet, to reward ourselves for the hard work that got us there.

I spent my first grant cheque on shares in Rolls Royce, buying and selling, doubling my money in an early privatisation, all very sensible for an Economics student in Thatcher’s Britain. But don’t worry, by the time I got to my final grant cheque I’d lightened up - I blew it on Hi-Fi separates, a CD player, amp, speakers, and a Chris Rea CD. No regrets though because both investments brought joy in different ways.

It’s funny how we view money differently depending on its source. Our salaries can easily get assimilated into our lives almost before we notice – this is especially true after we get incremental pay rises. While on paper a rise might sound great, in reality, the novelty of the extra cushion soon gets forgotten. A bonus, on the other hand, feels like a chance to treat ourselves.

It’s why so many people spend their Christmas bonus differently from their regular salary, as hilariously illustrated in National Lampoon’s Christmas Vacation. In the film, Clark Griswold dreams of using his long-anticipated Christmas bonus to fund a lavish new swimming pool for his family. He even puts down a deposit before the cheque arrives, only to be blindsided when the bonus turns out to be a subscription to a jelly-of-the-month club. Chaos ensues, but the moment captures something relatable: the emotional significance we attach to bonuses or windfalls and the plans we make around them.

The real question is: should we spend like this?

My answer is sometimes, yes. Money is only as useful as it helps you live the life you want. You’ve worked hard to save, which is why I’m so keen on reminding you that it’s okay to spend. That’s part of my job - to run the numbers, map out scenarios, and reassure you that you won’t run out of money. Enjoying the fruits of your labour isn’t reckless; it’s one of the reasons you worked so hard in the first place.

I encourage my daughter Sophie to embrace this mindset. She worries about spending £150 a month on her gym membership, but I remind her it’s something she loves. It’s part of the life she wants to live, and that’s what money is for. It can’t all be saved for the future.

How can we be more mindful of the enjoyment that can come from money instead of the stress of it? Well, let’s go back to that question: what would you spend your first pay packet on now? Whether it’s a bonus, an inheritance, or just a bit of unexpected good fortune, remember: money is there to fund the life you want to live - not just sit in a bank account.